|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

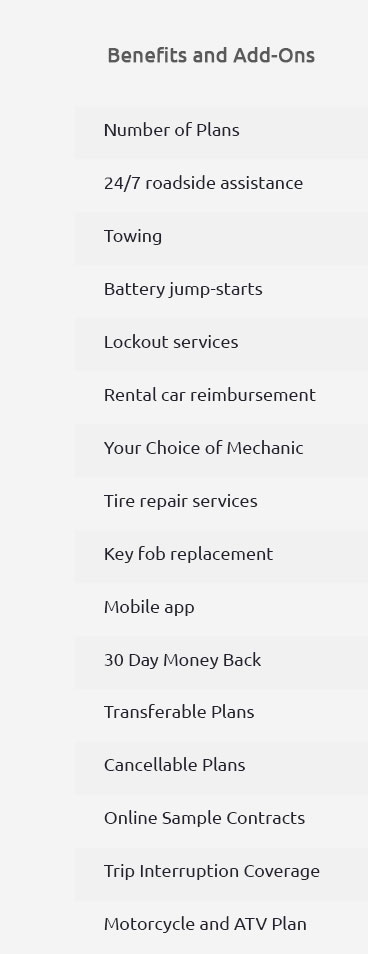

Car Coverage Insurance: A Comprehensive Coverage GuideExploring car coverage insurance can seem daunting, especially for U.S. consumers seeking to protect their vehicles against unexpected repair costs. Understanding the benefits of car coverage insurance is essential for peace of mind and long-term cost savings. Understanding Car Coverage InsuranceCar coverage insurance provides financial protection against unforeseen vehicle repairs, helping you manage costs more effectively. This type of insurance is especially beneficial in states like California and New York, where repair costs can be exceptionally high. Types of CoverageCar coverage insurance can include several types of protection:

Benefits of Extended Auto WarrantiesMany drivers opt for most reputable extended auto warranty services to further protect their vehicles. These warranties offer extended coverage beyond the standard manufacturer warranty, covering major components like the engine and transmission. Peace of mind and cost savings are two major benefits of extended warranties. With repairs potentially costing thousands of dollars, having a warranty can significantly reduce out-of-pocket expenses. What is Covered?Coverage varies, but generally, car coverage insurance includes:

For example, if you own a high-end vehicle like a Porsche, a porsche extended auto warranty can be crucial in mitigating repair costs. FAQsWhat is the average cost of car coverage insurance in the U.S.?The average cost varies widely based on location and vehicle type, but it typically ranges from $1,000 to $2,500 annually. In urban areas like Los Angeles, premiums may be higher due to increased risk factors. Is it worth purchasing an extended auto warranty?Yes, especially for owners of older vehicles or those with high repair costs. Extended warranties can provide substantial savings and peace of mind by covering expensive repairs. Does car coverage insurance cover regular maintenance?Typically, regular maintenance such as oil changes and tire rotations are not covered. These costs are considered the responsibility of the vehicle owner. In conclusion, car coverage insurance is an invaluable tool for vehicle owners looking to protect themselves from unexpected repair costs. By understanding your options and choosing the right coverage, you can enjoy the open road with greater confidence and security. https://www.allstate.com/resources/car-insurance/types-of-car-insurance-coverage

Types of car insurance coverage - Auto liability coverage - Uninsured and underinsured motorist coverage - Comprehensive coverage - Collision coverage ... https://www.tdi.texas.gov/pubs/consumer/cb020.html

Texas law requires you to have at least $30,000 of coverage for injuries per person, up to a total of $60,000 per accident, and $25,000 of coverage for property ... https://www.iii.org/article/what-covered-basic-auto-insurance-policy

What is covered by a basic auto insurance policy? - Bodily injury liability - Medical payments or personal injury protection (PIP) - Property damage liability.

|